Paying Illegals to Stay IRS Gives Out Billions Each Year !!!!

http://www.cis.org/paying-illeglas-to-stay

To crib from Caesar, all immigration policy is divided into three parts: you can enforce the law and deport the illegals, you can ignore them (and there is a lot of that going around), or you can pay them to stay in this country.

Not even the White House is publicly advocating the third option, but recently the Treasury took exactly that approach, and sent $4.2 billion to families of illegal aliens, as CIS reported in blog at the time.1

Why and how this came to pass is an unusual story with a plethora of players — including two heroes — about how our government works and how faceless, midlevel decision-makers can, and do, shape our basic policies. And how the courts are, in effect, powerless to do anything about it.

This particular paying-the-illegals-to-stay pattern revolves around the Additional Child Tax Credit (ACTC), which is not so much a tax credit as it is an income-transfer program for low-income families, offering up to $1,000 per child to all resident families, including those of illegal aliens. The Treasury Department’s Inspector General for Tax Administration estimated that $4.2 billion had been sent in ACTC checks to families of illegal aliens in a single tax season.

The story of this scandal involves these ingredients:

- A fuzzy-minded Congress;

- An almost casual policy decision by IRS to make these payments to illegals;

- A still lower-level decision by IRS that made it easy for applicants to submit phony documents to support applications for ACTCs;

- Other practices by IRS making it easy for illegals to get big refunds in this program;

- A remarkable journalistic intervention in Indianapolis that broke the story;

- A highly useful set of reports by a Treasury Department inspector general; and

- A half-hearted, needlessly narrow effort by IRS to clean up at least part of its act.

This is one of those perfect-storm situations, in which a whole series of factors come together to cause the problem, in this case shelling out billions to help illegal aliens stay in the United States.

ACTCs and ITINs. Here are the basics in the situation: There are two kinds of tax credits in the income tax system, the more common non-refundable credits (for many things like charitable contributions and mortgage interest payments) and refundable credits (for a short list of items). The former can only be used to lower the tax owed; but in the latter, if the credit is large enough the Treasury will send an income tax filer a check, even if no income tax was owed. Since 1997, ACTCs have been part of the system as refundable credits.

Usually, such as in the Earned Income Tax Credit (EITC) program, which also involves refundable credits, the filer and his or her dependents must have Social Security numbers (SSNs) to obtain a refundable credit; this is not the case with the ACTC program.

Since earned income is taxable whether or not the worker is legally in the country, the IRS had to create a system to identify individuals who had tax obligations even though they were not here legally. Hence the Individual Taxpayer Identification Number (ITIN). But the IRS also decreed that ITINs can be used to identify dependents when SSNs are not legally obtainable. (One must be a legal resident of the United States to get an SSN.)

It is the use of ITINs by illegal alien income tax filers for themselves and for their dependents in the ACTC program that caused the $4.2 billion in payments.

Underlying Policy Questions. Before we get into the facts of the case, it may be useful to think about a set of related policy questions, with those at the top of the list easier to answer than those further down. I have added my own suggested answers.

- Should any illegal alien get ACTCs for non-existent children? Absolutely not.

- Should any illegal alien living in the United States be given ACTC credits for children living overseas? Of course not, but from the population-explosion point of view, it is mildly better that they be somewhere other than the United States.

- Should illegal alien parents in the United States be given ACTC credits for their illegal alien children living in the United States? No, it is hard on the kids, to be sure, but such payments would simply encourage illegal aliens to come to the United States and stay here.

- Should any illegal alien parents in the United States be given ACTC credits for their U.S. citizen children, kids who do exist and whose U.S. birth can be documented? That’s a tougher one, as long as we maintain birthright citizenship. Incidentally, such kids do qualify for SNAP benefits (aka food stamps), but should they also get AC TC, as they do now?

These four questions are separate and distinct from a more basic one: should any illegal alien get any of the tax breaks, including ACTC, that are appropriately available to citizen and resident taxpayers? Congress, as we are about to see, has been of little help on many of these issues, and of no help on the most basic of them: Should any illegal alien get these tax breaks?

A Fuzzy-Minded Congress. The first (quite preventable) problem in this complex area was created on Capitol Hill, but it is not the only difficulty, as we will see. Congress could have easily voted that ACTC benefits, just like EITC benefits, could be issued only to people with SSNs. It did not do so.

Meanwhile, in a different vote at a different time, Congress decided, generally, that no federal “grant or benefit” could be given to illegal aliens and it did not define either of those terms.

This was a provision in section 401 of the Clinton-era welfare act, the Personal Responsibility and Work Opportunity Reconciliation Act of 1996.

So, are all those $1,000 ACTC checks “grants” or “benefits” under PRWORA? Congress left that decision up to the Executive Branch, more specifically to the IRS.

The IRS’s Rather Casual Decision. You would think that if a federal agency were going to make a multi-billion dollar decision regarding an ambiguous piece of legislation, such as “should we give illegal aliens ACTC benefits?” It would do so in the usual, formal way. There would be a notice of the contemplated decision in the Federal Register, a request for comments, and later a formal publication of the ultimate decision.

However, according to a detailed, useful report by the Congressional Research Service (CRS) on the subject:2

There is no indication that the IRS considers any refundable tax credits to be subject to PRWORA Section 401. It does not appear the agency has issued any regulations, rulings, or other guidance on the issue. If the IRS were to permit unauthorized aliens to claim any refundable credit that does not include a statutory SSN requirement, as appears to be the case currently, then there is a serious question as to whether that position could be challenged in court.

Now CRS, an arm of the Library of Congress, is no restrictionist advocacy organization; if anything, its writers tend to be both very careful and pro-migration. So if such an entity wonders about this IRS decision then it is, indeed, a “serious question”.

The CRS comment above related to the level of formality of the decision-making system; saying that the more formal the process, the more likely that a federal judge would be to give the agency deference regarding that decision. The CRS suggestion is that no such deference is due the IRS’s informal decision in this matter.

As CRS points out, however, a judicial review of the decision seems unlikely because taxpayers, generally, do not have standing in the courts on such matters, and illegal aliens getting the benefits anyway have no cause to take the matter to court. So only the Executive or the Legislative Branch could reverse that decision, and neither seems to be so inclined.

What I find interesting in this case, and not discussed anywhere, is the sense that this multi-billion dollar decision to pay illegal aliens this credit seems to have been made at the mid-levels of the bureaucracy without any visible political input.

First, as the CRS notes, the decision does not seem to have risen to the level of even a policy memo, much less an entry in the Federal Register, both of which would have called for some high-level scrutiny. Secondly, though some on the right may disagree with me, the IRS is one of the agencies in the federal government that has the fewest political appointees, just the commissioner and one or two of his or her aides, and that’s about it.3 My sense is that several years ago a couple of GS-15s decided that the 1996 welfare reform did not apply to the ACTC benefits for illegals, and the decision has stuck.

Issuing ITINs by the IRS. If the relatively grand decision to let illegals have ACTCs was made at a modest level in the IRS hierarchy, the initial decisions on how to handle the issuance of the ITINs necessary to claim the ACTCs were made still lower in the bowels of the bureaucracy, and not even in Washington.

To review: At this point, Congress has punted on the question of illegal aliens’ eligibility for these benefits, the IRS has decided, rather casually, that it is OK to give ACTCs to illegal aliens, and now at the third step in this four-step process, the question is: How careful will the IRS be in the issuance of the numbers (ITINs) that lead to the ACTC refunds?

The current (September 2013) IRS instructions for filing the Form W-7, the application that leads to the issuance of an ITIN, say that one must submit documents that will establish both the identity and the foreign status of the individual.4 One and only one document will do both, and that is a foreign passport. Lacking that, an applicant will have to submit two documents from a list of 12. Some of the 12 are reasonably secure, such as visas issued by our State Department; others are less so, such as an overseas birth certificate, or medical records (for those under six), or school records (for those under 14).

All W-7 applications are sent to the IRS processing center in Austin, Texas, and there decisions are made in an apparently hurried manner by either IRS permanent civil servants or by IRS temporary hires.

The answer to the earlier question about how carefully this is done is, apparently, not at all a couple of years ago, and a little better now, as we will explain later.

The Process of Issuing Tax Refund Checks for ACTCs. The fourth and final step in the decision-making process takes place neither in the Austin Service Center, nor in Washington, but at other IRS service centers around the country where the individual 1040 and 1040NR (for non-resident) forms are processed, including in many cases claims for ACTCs supported by ITINs.

As far as I can gather, this seems to be a rubber-stamp operation and has not changed noticeably in recent years. Once the ITIN has been issued, there seems to be little, if any, attempt to question the filer’s eligibility for ACTC benefits, so the refunds keep flowing. A little later I will suggest some alternative measures that could be taken during this part of the process to thwart the inappropriate payment of ACTCs.

A Journalistic Intervention. This whole sleepy, wasteful bureaucratic process might have ground along without any outsiders knowing about it except for the alert work and continuous prodding of a single journalist, Bob Segall, a senior investigative reporter for WTHR-TV in Indianapolis.

Segall’s first story on the subject5 aired on April 26, 2012, after he heard about the widespread misuse of the ACTC program from an anonymous Indiana tax consultant who told him of many income tax returns filed by illegal aliens who were — successfully — claiming the Additional Child Tax Credit of as much as $1,000 each for each of as many as a dozen dependents. One of the problems was that many of the children, including nieces and nephews, lived in Mexico; ACTC is supposed to apply only to people actually living in the United States.

The tax preparer told Segall that many, many such returns were filed in his part of the state every year, with heavy negative consequences to the rest of the taxpayers. The reporter tracked down one undocumented worker:

[W]ho was interviewed at his home in southern Indiana [and who] admitted his address was used this year to file income tax returns by four other undocumented workers who don’t even live there. Those four workers claimed 20 children live inside the one residence and, as a result, the IRS sent the illegal immigrants tax refunds totaling $29,608.

13 Investigates saw only one little girl who lives at that address (a small mobile home). We wondered about the 20 kids claimed as tax deductions?

“They don’t live here,” said the undocumented worker. “The other kids are in their country of origin, which is Mexico.”

The $29,608 in refunds presumably included many thousands of dollars worth of non-ACTC tax credits, some, or maybe even all of them, legitimate. IRS routinely over-withholds on many U.S. taxpayers, setting in motion refunds later.

Did IRS, with its sophisticated computer systems, notice that it was sending 20 ACTC payments to a single address in a trailer park? Apparently not.

In subsequent investigative reporting, Segall asked IRS about these problems, with little success. He also stirred up interest in the matter within the state’s congressional delegation.

The Austin IRS Service Center. Then the Indiana reporter got another breakthrough; IRS staffers in distant Austin, Texas, heard about his article and almost a dozen of them started giving him chapter and verse on a key issue in this situation: how aliens could fiddle the ACTC system by filing phony claims for ITINs for relatives that did not exist, or lived outside the country; how these ITINs could lead to year-after-year illicit payments of $1,000 each, for each non-existent or non-US-resident dependent; and how sloppy the application review process was.

There were two basic problems, the IRS staffers explained. The first was that the management of the Austin service center was, at the time, interested in only the quantity of decisions, not the quality. The bosses there wanted to make sure that the ITINs were issued quickly. They actively discouraged questions about the legitimacy of applications. Adjudicators who took too much time with questionable applications were given lower grades on their evaluations; this was particularly troublesome to the lightly trained temporary workers holding many of these jobs — if they moved too slowly they feared they would not get hired again for the next tax season.

One of the IRS staffers said this, as reported by WTHR-TV:6

“We see the same docs photocopied and attached to different applications. It’s the same person, same photo, same address I’ve seen the same birth certificate 12 times now in the past day. You see it all on an ITIN applications,” the IRS insider said.

“So what do you do with the application,” we asked.

“If the document is there, process it,” admitted the insider.

The second basic problem was that the documents they were supposed to judge were largely written in languages other than English. The adjudicators were not hired because of their linguistic abilities and IRS rules, unlike those of U.S. Citizenship and Immigration Services in similar situations or require the applicants to routinely submit translations of the documents in other languages. Further, regarding these documents, the IRS practice was to accept notarized photocopies of originals, in addition to originals, and those certified by the issuing agency to be genuine copies of the originals. The acceptance of the notarized documents made fraud easier.

The combination of these two elements — the supervisors’ attitude and the ground rules — all but guaranteed that a large number of fraudulent applications would float by undetected.

The Treasury Department’s Inspector General for Tax Administration (TIGTA) Weighs In. There are two heroes in this story: one is Bob Segall, the TV reporter in Indianapolis, who was rewarded the Eugene Katz Award for Excellence in the Coverage of Immigration by the Center for Immigration Studies earlier this year,7 and the other is J. Russell George,8 the Treasury’s IG for tax matters.9

While their reporting styles, and their access to government records were quite different (the IG can look at anything that interests him), their findings were quite similar: the Treasury’s handling of the ITIN matter was disgraceful and something should be done about it.

There were three TIGTA reports in three successive years. In the 2011 report,10 the IG stated that $4.2 billion in refundable tax payments (presumably largely ACTCs) were paid to tax filers using ITINs in the “tax processing year 2010”.

The 2012 report11 pointed out that the incentives were all wrong at the Austin service center, and that the definition of acceptable documents was too loose. It recommended different and more demanding quality-control measures regarding the issuance of the ITINs, and called for the acceptance of only original documents or copies of documents certified by the originating agency.

The 2012 report also pointed out that there were patterns in which there were massive, and (in my eyes) suspicious concentrations of mailings of approved ITINs and ITIN-related tax refunds to specific postal addresses.

There were, for instance, 23,984 tax refunds involving ITINs sent to a single address in Atlanta, Ga. The aliens using that address collected $46,378,040 in refunds, or about $2,000 each. Another tabulation showed that 15,795 ITINs were dispatched to a single address in Phoenix, Ariz.

The IG’s concern was that IRS did not use this concentration information to identify potential sources of fraud.

This is a frustrating part of the IG’s 2012 report because there is a lot of text on these mailing concentrations that has been redacted; in fact, the full text of the ninth recommendation of the IG was eliminated in the 2012 report, and it may have dealt with this issue. I assume that these sections of deleted text dealt largely with IRS fraud detection techniques, and that the copy was eliminated because it might give fraudsters clues as to how the agency operates.

The Implications of Concentrated IRS Mailings. The practice of sending hundreds and thousands of IRS payments and ITINs to a single address certainly is suggestive of possible fraud, but neither Segall nor the IG’s office spells out the details of this practice. Let’s look at the threat scenario, or, if you prefer, the crook’s business plan.

But first, let me recall an off-the-record conversation I had with an immigration judge some time ago. He was in his robes sitting behind his elevated desk and I was the only other person in the courtroom; we got to talking between cases. He knew that I did immigration research and I had asked him why he had become an immigration judge.

After I got out of law school, I practiced immigration law, then I went to work as a lawyer for INS, and then became a judge. One of the attractions of this job, and the one at INS, is that there is always a paycheck from the government every other Monday. When I was in private practice I spent about as much time collecting or trying to collect my fees as I did on substance of the cases.

There are some similarities between the financial situation of the then-immigration lawyer (a totally honorable guy) and the here-and-now income tax preparers in ITIN cases. Both were/are usually dealing with low-income clients; both provide services in one time frame, which will, if successful, lead to a financial or a legal status gain to the migrant at some future time. Getting paid for such services is hard at best, and getting paid in advance is virtually impossible.

But there is a major difference in the situation of the tax-preparer as opposed to that of the one-time immigration lawyer. The benefit in the former case is routinely mailed to a given address, and if they all are mailed to the office of the preparer, he has physical possession of the check or the ITIN that is destined for the alien. The middleman can demand payment for his services before he turns over the IRS item to the alien. It is a sure-fire, no-fuss, no-muss collection technique.

The technique works equally as well if the 1040NR or ITIN preparation had been honest or dishonest, and so it is no wonder there were all those refunds and ITINs mailed to those single addresses noted by the IG.

There is, of course, another, grimmer version of this threat scenario. There are no children anywhere; they are all invented, or non-resident, as Segall found in the trailer park.

IRS Makes a Useful, if Tepid, Response. Following the criticism by both the IG and the Indianapolis TV station, IRS changed its ITIN application review processes in June 2012.12 These were the principal changes:

- Only original documents, and certified copies by the issuing authority, are to be accepted with the ITIN applications; notarized copies will no longer be OK, an important step;

- New review procedures were put in place;

- The IRS staff incentives system were to be tilted toward quality instead of quantity; and

- ITINs would no longer be valid forever, but would expire after five years.13

In addition, according to reporter Segall,14 the Austin service center issued to each of the adjudicators “a pamphlet from the Department of Homeland Security, a flashlight, a blue light, and a magnifying instrument”, presumably to detect fraudulent documents.

He also said that the Austin staff had been hampered by constantly changing rules on the ITIN work, and that staff members were not confident that the policy stressing the quality of the decisions, rather than their quantity, would persist. And, as one staff member added, “We just don’t get a lot of training.”

Further, there apparently has been no change in the IRS policy that their largely monolingual staff must sort through untranslated raw material. (IRS rules say that if the agency asks, the applicant must provide translations, but this is only an exceptional procedure, not a routine one.)

The actions described above are obviously useful, forward steps, but small ones, and they are making a measurable impact on the distribution of the ITINs. According to the previously cited 2013 report of the Treasury IG:

[T]he number of [ITIN] applications rejected as questionable increased from 226,011 for the period July through December 2011 to 340,659 for the same period in 2012.

Not only did the number of applications denied increase in absolute terms, as shown above, the percentage of denials to submissions also increased from 38 percent to 64 percent, according to the report. Further, if you project from the percentages and the number of denials, as the report does not do, you will see that the total number of applications, perhaps influenced by the increasing denial rate, fell from about 594,000 in the earlier period to 532,000 in the later one.

In short, there was significant progress regarding these decisions as measured in three different ways.

Now, not all of these are for illegal aliens, but those who argue that illegal migration is fading away should note that these are applications for new, and thus additional, alien numbers, reflecting the arrival, or in some cases the “arrival”, of more than one million more aliens who are not eligible for SSNs!

Goodness!

There is a sort of shut-down-the-border-but-ignore-interior-enforcement mindset working here. The IRS is working to prevent the issuance of fraudulently obtained new ITINs, which is good, but is not doing much about the population of bad, old numbers that will continue to tap the Treasury for billions, year after year.

Actions Not Taken by IRS. These non-actions come in two categories. First, there are the recommendations of the IG on the ITIN issuance procedures that the IRS rejected, and then there are the fraudulent-payment-prevention actions, which I think are implicit in the IG’s work, but were not recommended by that office.

On the first set of non-actions, in 2013 IG reported (in governmental prose) that IRS had not followed its suggestions to:

Analyze information . . . to identify indicators of questionable ITIN applications for the purpose of proactively identifying questionable applications during processing

Establish organizational lines of responsibility, processes, and procedures for detecting, referring, and working ITIN application fraud schemes.

Here’s a simple and striking IG-suggested example of such a missed opportunity. IRS has a large collection of rejected ITIN applications, and has the addresses attached to them. Why not review new applications from those addresses with special care? Further, why not go back through the old decisions to grant ITINs to people at those addresses and review them again? These things are apparently not happening.

Then there is the second set of non-actions that are even more significant than the IRS decision not to take the IG-recommended steps regarding ITIN numbers; it is also apparent that IRS is not taking a variety of steps to prevent the payment of benefits to those using questionable ITIN numbers.

This situation is complicated by politics: there are forces on the right that want to curb illegal immigration but are more interested in cutting back on the IRS; meanwhile, the administration, which is perfectly happy to spend IRS dollars on collecting from the rich, has no particular interest in using the same money to curb illegal alien abuses of the tax system. As a result of this two-way squeeze, the IRS does not do as much as it could to prevent the payment of undeserved tax breaks to the illegals.

It should be added that these IG reports all relate, primarily, to the issuance of ITINs, rather than to broader matters, so some useful actions may be underway about denying inappropriate benefits that are not mentioned.

Within these two general contexts let’s discuss some things that IRS could do — beyond being careful with ITINs — to prevent the subsidization of illegals with tax funds.

The IG report for 2012 is full of examples of matters that should be pursued, and apparently have not been, because IRS disbanded the questionable identification detection team that used to work on such matters.

There was, for instance, a pattern of single addresses linked to questionable refund schemes, identified earlier by the IRS, and the subsequent volume of ITINs and refunds sent to those addresses. In one example there were seven schemes, seven addresses, and more than $9 million in refunds mailed to those seven addresses.

There were also simple concentrations of ITINs at single mailing addresses, with the national champion being a single address in Atlanta, Ga., that 23,994 ITIN-related tax refunds were sent to. And 8,393 ITIN refunds were deposited in a single bank account.

There was, similarly, an address in Phoenix, Ariz., that was used on 15,718 applications.

One might reasonably be suspicious that these patterns could well involve fraud.

Over and above this low-hanging fruit identified by the IG, it strikes me that some other patterns involving ITINs — on a less massive scale — might be investigated:

- Rapid expansions of the numbers of ITIN-dependents claimed by the same individual when two filings in sequential years are compared; say, moving from none in one year to four or five in the next;

- Unusual patterns of youthful applicants with large numbers of dependents — e.g., an 18-year-old with four children; or

- Birth-date patterns of claimed “children” that appear to be too frequent to be believed, two children born within seven months of each other, for example.

The reader should bear in mind that children born in the United States — individuals who can obtain SSNs — are not in this mix. ITINs are issued only to people who cannot secure SSNs.

A Particular, Odd ITIN Concentration in the Delmarva Peninsula. One section of the 2012 IG report (on page 8) caught my eye. There was this bit of text:

In addition to the previously discussed analysis [of the various concentrations] we performed during the course of our review, tax examiners sent us information about what they suspected were potential ITIN application schemes for which no action was taken by [IRS] management.

Then eight lines of text, maybe consisting of 100 or so words, were redacted. Then the non-redacted text resumed as follows:

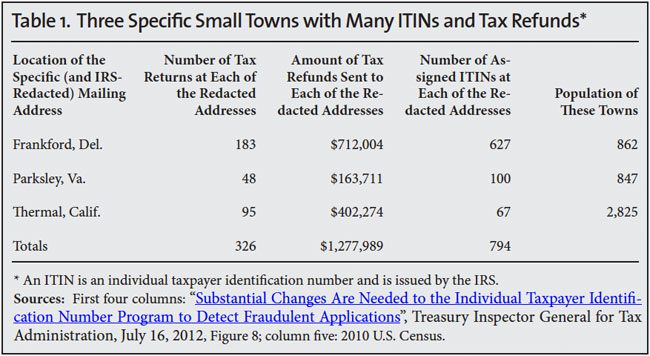

Using this information, we identified that 794 ITINs were assigned to individuals at these addresses and 326 tax returns were filed with refunds totaling approximately $1.3 million issued to these three addresses. Figure 8 provides an analysis of the addresses that the tax examiners provided.

The data in the IG’s Figure 8, supplemented by Census data, are in our Table 1.

For some reason these concentrations of ITINs and tax refunds, notable but not on the scale of the nearly 24,000 ITIN-related tax refunds sent to the single Atlanta address, attracted the attention of the IG staff. Why it came to their attention is presumably described in the eight redacted lines, but it remains a mystery to the non-Treasury reader.

What I noticed from the report, and Table 1, was that the three towns cited were all small ones in labor-intensive agricultural areas. There are table grapes near Thermal, Calif., which is a desolate little town near the Salton Sea in the southern part of the state. There are some truck farms (strawberries, for example) and many poultry plants near the other two towns, which are, oddly, of almost exactly the same population and within 70 miles of each other on the Delmarva Peninsula.

I was curious to see if the redaction-caused mystery could be solved by a visit, and wondered what was known in those two tiny towns about what the IG had found. So I spent a couple of days in the area.

Both Frankford (Del.) and Parksley (Va.) are on the north-south rail line that runs down the peninsula, both are full of old and modest houses, and there are few signs of the seaside prosperity that lies a dozen miles to the east. Both have poverty levels above those of their respective states, and both have white, black, and Hispanic populations, in that order. The biggest economic force is the poultry industry, the growing and the processing of chickens on an industrial basis. A huge complex of chicken feed elevators, for examples, looms over Parksley.

The alien population is, in rough order, Mexicans, Guatemalans, and Haitians. The two Hispanic populations consist of the usual mix of legal and illegal residents, I was told, and the Haitians, apparently, are more diverse including legal residents, illegals, those with Temporary Protected Status (said to be recruited in Miami by Perdue), and perhaps some H-2Bs working in the chicken plants.

These are, by the way, not range-fed chickens, and one does not see them on the farms, since they are confined to long sheds. The only live chickens I saw were in crates piled high on 18-wheelers being hauled to their fates. In fact, there are very few visible farm animals in the area I visited; one herd of sheep and several groups of two or three horses.

The degree of awareness of the IG’s report was quite different in the two towns.

I visited Frankford first, and found no knowledge of either the Treasury report or any sense of any suspicious activity. It was all news to the single clerk at the post office, and to his boss the postmaster who worked in another facility. The otherwise knowledgeable and outgoing staff of the village (one woman was the entire staff) knew nothing about it, nor did a state employee that I encountered in the town hall. (He works for the nearby state-run training school for volunteer firemen.)

That person, when I explained what I was after, speculated that it might be the work of the MS-13 gang of Central Americans, which he said was active in the area. I suggested that this was not the kind of criminal activity MS-13 is best known for, and he replied “they have a monopoly here; there are no other gangs to fight with, so maybe it is part of their operation.” He may be right, but no one else made that suggestion.

I then tried to pass along the admittedly sketchy report of the IG — I had copies of it with me — to local law enforcement entities. No one seemed very interested. No one at the local prosecutor’s office would talk to me about it, saying that such reports should be filed with the state police. A state police corporal accepted the copy of the IG’s report and said he would turn it over to the sergeant at the barracks who covered financial crime, but showed little interest in the matter.

I had figured that a government report on a suspected local illegal activity (such as that in the IG’s document) would interest local law enforcement on the grounds that it might dovetail with some local intelligence on other criminal activities. Not so.

I found the Frankford postmaster at a mid-sized mail handling facility; she told me that she had 5,000 mail customers and could not know of such things as the IRS mailings, but she did agree to turn over a copy of the IG’s report to the postal inspector for her area, who was headquartered in the Philadelphia suburbs. She was dutiful about receiving the information, but again, did not appear to be particularly moved by it.

Her clerk at the little post office in Frankford was interested and chatty. He said that mail for people in town was handled through post office boxes, and that people in the surrounding area had rural delivery. The address cited by the IG could be in either category. He recalled receiving a batch of mail from the IRS that was addressed to a non-functioning PO box at his place, and said that it was returned to the IRS. He did not know anything else relevant.

Parksley was different.

There the post office was a one-woman operation. After introducing myself and the IG’s report, I asked her if I was the first person from out of town to raise a question about it, and she said “no.”

“So you had a visitor?” I said.

“Yes,” she said.

“A postal inspector?”

“Can’t tell you.”

The White Pages list three income tax counselors in Parksley (but none in Frankford). I found that one of the three in Parksley knew all about the IG report, because it had been covered in the local paper. She showed me the clipping. Further, she said that she suspected that one of the other two income tax preparers was probably the culprit, and she specified which one. (I looked for that person, but the office was closed.) My informant said that she, as a matter of principle, did not handle ITIN applications.

The tiny town hall and police station in this place was locked when I was there.

What I found, briefly, was this: that some unknown segment of the government (probably either the IRS or the postal inspectors) was active in one location, but apparently not in the other; that the IG’s office had not made any obvious effort to share its (partially redacted) story with local authorities; and that while people were polite to me and mildly interested in my story, there did not seem to be any deep, underlying concern about the presence of illegal aliens in their midst.

Further, I was reminded of how structured law enforcement can be, and what a narrow focus many officials can have about their jobs and matters that do not fit conveniently into neat categories.

What I did not find, of course, was the meaning of those eight lines of redacted text in the IG’s report, but I am pretty sure that they dealt with some aspect of our government’s habit of paying illegal aliens to stay in this country.

End Notes

1 See Jim Edwards, “Illegals Raiding U.S. Treasury”, Center for Immigration Studies, September 5, 2011.

2 Erika K. Lauder, Ruth Ellen Wasem, et al. “Ability of Unauthorized Aliens to Claim Refundable Tax Credits”, Congressional Research Service, R42628, July 26, 2012.

3 Once during my checkered career I was — though we did not use the title — the chief patronage mechanic of the Democratic National Committee during a prior Democratic administration. We called lots of federal agencies all the time, trying to get appropriate consideration for deserving Democrats, but we never phoned the IRS.

4 Instructions for Form W-7, IRS, 2013.

5 See Bob Segall, “Tax loophole costs billions”, wthr.com, April 26, 2012.

6 See Bob Segall, “IRS workers OK “phony” documents from illegal immigrants”, wthr.com, May 24, 2012.

7 For a full set of Segall’s televised stories, see here, and for a transcript of the CIS awards ceremony story see here.

8 For a biography of IG George see here.

9 Most cabinet agencies have a single IG, but Treasury has two of them; the other works with non-tax matters.

10 See “Individuals Who Are Not Authorized to Work in the United States Were Paid $4.2 Billion in Refundable Credits”, Treasury Inspector General for Tax Administration, July 7, 2011.

11 See “Substantial Changes Are Needed to the Individual Taxpayer Identification Number Program to Detect Fraudulent Applications”, Treasury Inspector General for Tax Administration, July 16, 2012.

12 See “Review and Verification of Individual Taxpayer Identification Number Applications Has Improved; However, Additional Processes and Procedures Are Still Needed”, Treasury Inspector General for Tax Administration, May 2013.

13 This useful change appears to be something IRS figured out for itself; I could find no IG recommendation along these lines. Further, it is unclear whether the ruling on the five-year life of these numbers relates only to the newly-issued ones, or covers the whole population of existing ITINs. As many taxpayers know, this agency can be, at times, inscrutable.

14 See this July 23, 2013 WTHR-TV news story.

Comments are closed.