More On Energy Fantasy Versus Reality In Woke-Land Francis Menton

https://www.manhattancontrarian.com/blog/2022-6-5-more-on-energy-fantasy-versus-reality-in-woke-land

It’s official: the world is committed to rapidly reducing CO2 emissions. Just look at the the 2015 Paris Climate Agreement, or President Biden’s April 22, 2021 press release, or California’s SB 100 climate act, or New York’s Climate Leadership and Community Protection Act, or Germany’s Energiewende, or the UK’s Net Zero pledge, or any of many other such pledges.

And essentially all of woke corporate America is on board with the program. Consider the tidal wave of so-called “ESG” investing, focused on re-organizing corporate activities to reduce carbon emissions. Super-woke banking giant JP Morgan is leading the charge. From a recent JP Morgan press release:

JPMorgan Chase aims to finance and facilitate more than $2.5 trillion over 10 years – beginning this year through the end of 2030 – to advance long-term solutions that address climate change and contribute to sustainable development. . . . This long-term target complements the firm’s Paris-aligned financing strategy and will help accelerate the transition to a low-carbon economy by encouraging actions that set a path for achieving net-zero emissions by 2050.

And yet, somehow it just doesn’t seem to be happening. Australia’s ABC notices the disconnect in a June 3 piece with the headline “Climate scientists warn of increased climate change events as carbon emissions fail to drop.” Key point:

Emissions across the globe continue to rise despite nations committing to cut them.

All those many official pledges and commitments don’t seem to be having any effect whatsoever. The IEA reported in March that global CO2 emissions increased by a remarkable 6% in 2021 over 2020 (some of that representing rebound from the pandemic). The ABC piece is filled with wailings and lamentations of “climate scientists” about the impending disaster if emissions aren’t promptly slashed. (E.g., from University of Illinois professor Donald Wuebbles, “[W]e will see ever more damaging levels of climate change, more heat waves, more flooding, more droughts, more large storms and higher sea levels.”)

So what is the problem here? Isn’t reducing CO2 emissions down to about zero just a matter of building a few more wind turbines and solar panels?

For a serious dose of reality from an unexpected source, I highly recommend the 2022 Annual Energy Paper, released by none other than JP Morgan in early May. The author is a guy named Michael Cembalest, identified as Chairman of Market and Investment Strategy for J.P. Morgan Asset & Wealth Management. I previously covered the 2021 version of Mr. Cembalest’s annual report in this post from May 6 last year.

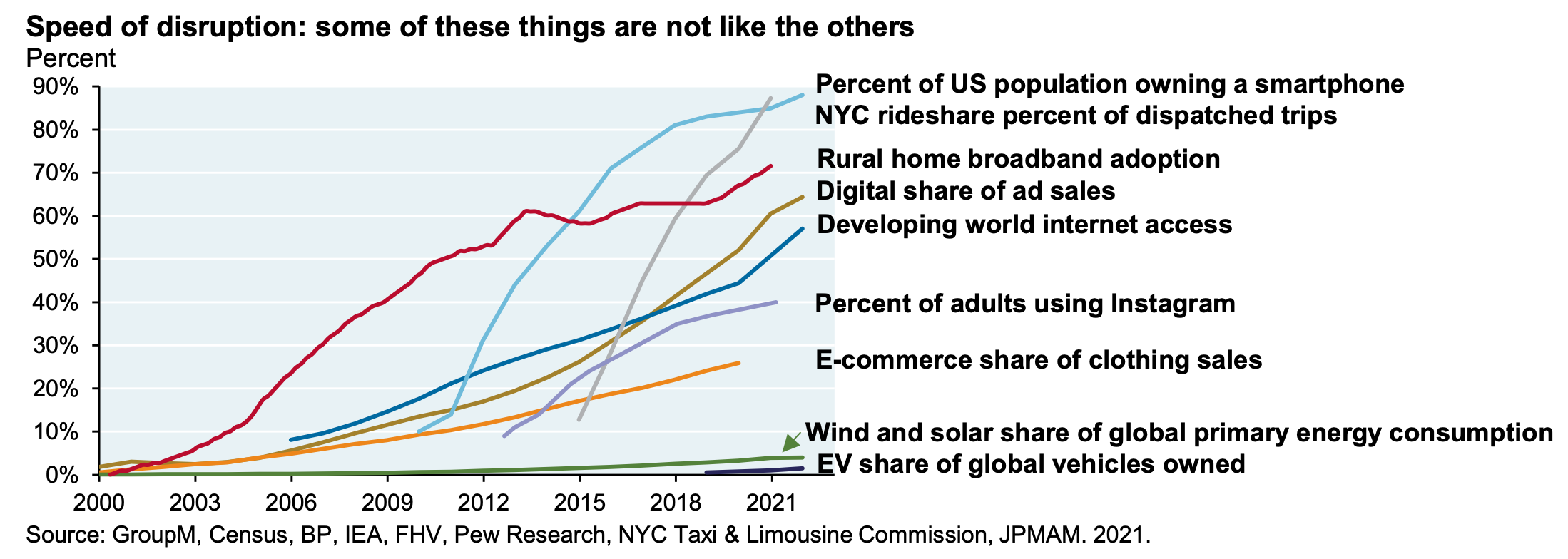

Here are a few highlights from Cembalest’s latest report. First, one of my favorite charts:

When the demand is there and the product works, it takes off. Not so for wind and solar for energy generation, nor for that matter for electric vehicles. Nobody buys these things unless subsidized, and as soon as government subsidies are reduced or go away, they disappear.

Next, Cembalest is totally on to the “levelized cost of energy” scam:

“[L]evelized costs” comparing wind and solar power to fossil fuels are misleading barometers of the pace of change. Levelized cost estimates rarely include actual costs that high renewable grid penetration requires: (a) investment in transmission to create larger renewable coverage areas, (b) backup thermal power required for times when renewable generation is low, and (c) capital costs and maintenance of utility-scale battery storage. I am amazed at how much time is spent on this frankly questionable levelized cost statistic.”

I would only quibble with Cembalest’s use of the word “questionable” to describe the levelized cost statistic. A more appropriate adjective would be “fraudulent.” But utilities in the real world need to grapple with real costs, including costs of additional transmission and storage, and can’t really be fooled by the misleading “levelized cost” comparisons.

Next, Cembalest has figured out that developed countries like the U.S. and Europe have manipulated their “carbon emissions” statistics by shifting high-energy-consuming manufacturing to developing countries, where the products are then produced mostly using coal:

Over the last 25 years, the developed world shifted much of its carbon-intensive manufacturing of steel, cement, ammonia and plastics to the developing world. While the developed world is projected to continue reducing its energy consumption, developing world energy consumption is projected to keep rising . . . . And as a reminder, coal is still widely relied upon in many developing countries, and also Japan. . .

Cembalest has the best brief summary of the impossibility of “carbon capture and sequestration” that I have seen:

The infrastructure required for meaningful geologic carbon sequestration would be enormous. In addition, the energy and materials requirements for direct air carbon capture are essentially unworkable. Here’s a quick summary of our conclusions on the topic from last year.

-

To sequester just 15%-20% of US CO2 emissions via traditional carbon capture and storage, the volume of US carbon sequestration (1.2 billion cubic meters) would need to exceed the volume of all US oil production in 2019 (858 billion cubic meters)/ That’s a LOT of infrastructure that does not exist.

-

Gathering and storing 25% of global CO2 through direct air carbon capture could require 40% or more of global electricity generation, even when assuming the presence of waste heat to power the carbon capture, requiring ~1,200 TWh per Gt of CO2. This is clearly an absurd proposition.

Here’s a great quip on the CCS fantasy:

One of the highest ratios in the world of energy science: the number of academic papers written on carbon sequestration divided by the actual amount of carbon sequestration (~0.1% of global emissions at last count).

Here’s a short paragraph on New York’s particular energy fantasies:

Since the shutdown of the Indian Point Nuclear Plant, coal- and gas- powered electricity imports from PJM have closed most of the gap. This fall, construction is set to begin on a 339-mile high voltage transmission line transporting Canadian hydropower. It has taken 17 years to get to this point, and the power line may not be completed until 2025. To conclude: the disconnect between transmission grid assumptions in Net Zero plans and what’s happening on the ground is almost as wide as the chasm between expectations and reality on carbon sequestration.

“PJM” is a regional interconnect facility that enables New York to import power from nearby states including Ohio, Pennsylvania, and even Tennessee, where they have many fewer compunctions about using fossil fuels.

There is much more of interest in the Report, which is 47 pages long. I should note that I don’t by any means agree with everything in it. My most important quibble is that the Report deals almost not at all with the energy storage issue. Still, it is refreshing to see someone in the center of Wall Street who is willing to deal with energy issues in a (basically) realistic manner, as opposed to the fantasies that almost completely dominate the discussion.

Comments are closed.