The U.S. Misery Index Worsens as Unchecked Bidenflation Grows By Gwendolyn Sims

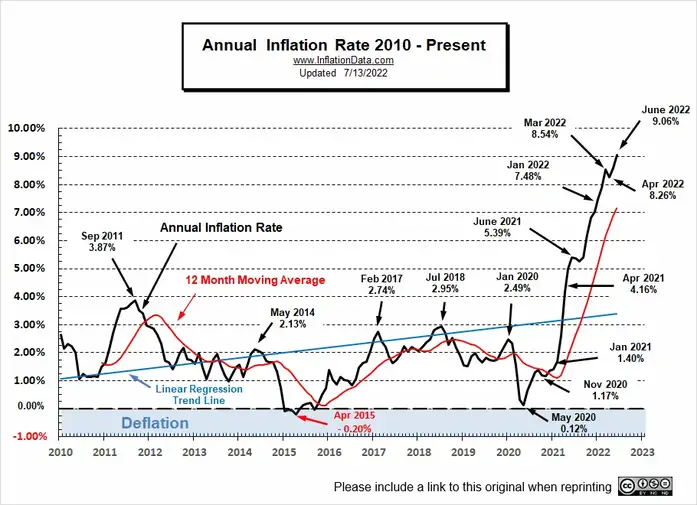

The U.S. government announced Wednesday that June’s federal inflation numbers increased to a staggering 9.06% — a 40-year high. According to the official Bureau of Labor Statistics (BLS) news release, inflation is being felt keenly and across the board:

The increase was broad-based, with the indexes for gasoline, shelter, and food being the largest contributors. The energy index rose 7.5 percent over the month and contributed nearly half of the all items increase, with the gasoline index rising 11.2 percent and the other major component indexes also

rising. The food index rose 1.0 percent in June, as did the food at home index.The index for all items less food and energy rose 0.7 percent in June, after increasing 0.6 percent in the preceding two months. While almost all major component indexes increased over the month, the largest contributors were the indexes for shelter, used cars and trucks, medical care, motor vehicle insurance, and new vehicles. The indexes for motor vehicle repair, apparel, household furnishings and operations, and recreation also increased in June. Among the few major component indexes to decline in June were lodging away from home and airline fares.

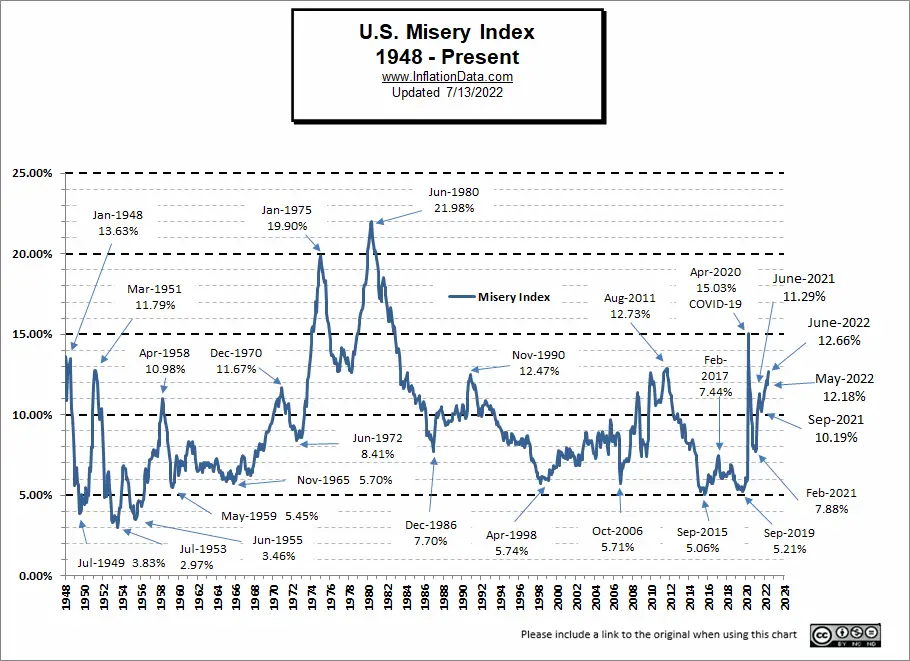

From the updated BLS data, economists quantify the economic health of the country. To do so, they add the current U.S. unemployment rate, which is a stagnant 3.6%, to the current rate of U.S. inflation, which is a jarring 9.06%, to produce a snapshot of the country’s economy. The result is known as the U.S. Misery Index.

The current U.S. Misery Index stands at a very miserable 12.66%.

With inflation at record-high levels not seen since 1981, it follows that the Misery Index would also climb higher over last month’s levels, causing increases in basic necessities like food, shelter, and gasoline. In other words, American consumers are definitely feeling the pain of Bidenflation in their wallets with every purchase.

So what exactly does the Misery Index tell us? First, we know that as the rate of inflation grows, the cost of living increases. If the unemployment numbers also rise, more and more people fall into poverty. In theory, adding those two rates together gives us the Misery Index, which acts as a kind of snapshot in time gauging the health of the economy as a whole. In practice and since both unemployment and inflation significantly impact the average American wage earner’s spending power, the Misery Index also gauges how negatively impacted the quality of American life is by Bidenflation. To put it another way, as the Misery Index climbs, the quality of American life declines.

Recommended: Truckers Say California Law Likely to Make U.S. Supply Chain Crisis Even Worse

And, while not perfect, the Misery Index is a useful tool to gauge the ups and downs of the U.S. economy under the Biden-Harris administration’s ruinous economic policies. With the soaring cost of living, most Americans are being forced to tighten their belts by cutting back on everyday expenses like groceries, gasoline, and housing. Simply put, inflation decreases the purchasing power of consumers for all purchases, not just luxuries.

Many experts like founder and CEO of Compound Capital Advisors Charlie Bilello believe, the true rate of inflation is even higher than the government is reporting when the Consumer Price Index (CPI) is considered. The “US wage growth has failed to keep pace with rising prices for 15 consecutive months,” tweeted Bilello on Wednesday. “This is a decline in prosperity for the American worker.”

Many experts like founder and CEO of Compound Capital Advisors Charlie Bilello believe, the true rate of inflation is even higher than the government is reporting when the Consumer Price Index (CPI) is considered. The “US wage growth has failed to keep pace with rising prices for 15 consecutive months,” tweeted Bilello on Wednesday. “This is a decline in prosperity for the American worker.”

Meanwhile, as my PJ Media colleague Matt Margolis pointed out, Biden continues to blame everyone and his grandmother for Bidenflation. “It’s hard to take Biden seriously that inflation is a top priority when the White House devotes so much time to crafting bogus talking points about who else is to blame for inflation or how inflation is supposedly worse elsewhere and then calling on Congress to enact price controls,” wrote Margolis. Biden has even gone so far as to claim that other countries have higher inflation rates than the U.S., which both Margolis and Bilello easily prove incorrect. “The problem with [Biden’s] claim was that Germany, France, Japan, India, Canada, Italy, and Saudi Arabia all had lower inflation rates,” Margolis added.

As inflation continues its climb into the stratosphere and the feds consider raising interest rates, it seems pretty clear that Bidenflation is here to stay no matter how the feckless Biden and his administration try to distract, gaslight, or deflect blame. Buckle up, dear reader, because the bad news is that the road ahead is looking mighty bumpy and more and more like Carter-era misery than Regan-era prosperity, however, November is coming.

Comments are closed.