Biden Student Loan Plan Backfire: Most Call It A Political Move — And Unfair: I&I/TIPP Poll Terry Jones

No doubt, President Joe Biden and his advisers believed student-loan forgiveness would be a big winner in the upcoming midterm elections. If so, it was a political miscalculation, with most Americans rejecting the idea as unfair and a political stunt, the latest I&I/TIPP Poll shows.

Under Biden’s plan, unveiled in late August, he will cancel up to $20,000 in student debt for those who had have Pell Grants and up to $10,000 in debt for those earn less than $125,000 per year, $250,000 for married couples.

By a margin of 59% to 32%, Americans agreed that Biden’s student-loan forgiveness plan “is unfair to those whose children are not in college or who have already paid for their kid’s education to have to pay for other people’s education.” Another 8% called themselves “unsure.”

Perhaps surprising is that the rejection of the idea is multi-partisan in nature. While Republicans, as might be expected, agreed that it is unfair at the highest rate (67%), Democrats (55%) and independents (56%) weren’t that far behind.

Among all respondents, only one group was below 50%: Those who self-identified as “liberals.” Just 42% of that group agreed student-loan forgiveness was unfair. Among “moderates,” the level of agreement was 60%; for “conservatives,” it was 72%, tied for the highest for any of the other major demographic and political groups that I&I/TIPP polls routinely measure.

The online I&I/TIPP Poll of 1,277 adults was taken from Sept. 7-9. It has a margin of error of +/- 2.8 percentage points.

Some other interesting, and perhaps surprising, trends emerged from the data. One was that, in general, the younger the respondent the poll, the more likely they were to agree that student-loan forgiveness was a bad idea.

Among those 18-24 years of age, 65% agreed it was unfair; for those 25-44, that number shrank to 60%; for the 45-64 group, to 57%; and for those over 65, it was 59%.

There was little difference between whites (60%) and blacks/Hispanics (58%). But there was a pronounced difference when it comes to income level: For those earning less than $30,000 a year, 53% said it was unfair; for those with $30K to $50K in income, it was 57%; those at $50K to $75K it was 62%; for those at the top, earning more than $75K, it was 72%.

What explains that last series of data? Possibly that, as repeated surveys and studies clearly show, income advances with education. Those with higher incomes thus are more likely to directly benefit or have their children benefit from loan forgiveness.

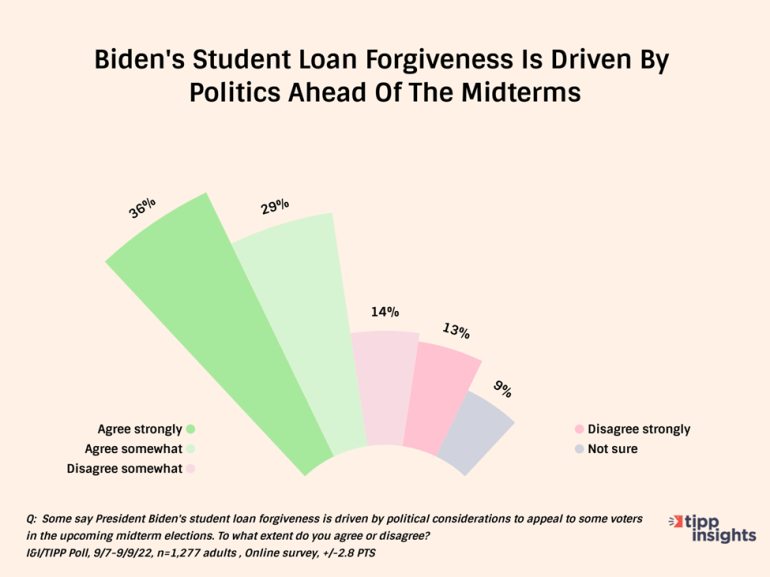

We asked a related question in this month’s poll, given the upcoming midterm elections: Namely, whether Americans agreed that “President Biden’s student loan forgiveness is driven by political considerations to appeal to some voters in the upcoming midterm elections.”

There, the share that agreed was even larger than with the first question: 65% to 27%.

And again, the political agreement was unexpectedly broad. Some 55% of Democrats said the student-loan forgiveness was politically motivated, compared to 78% of Republicans and 66% of independents.

Even among those with a college degree or higher, the group most likely to benefit from forgiveness, 67% agreed it was a politically driven move, compared to 66% of those with some college, and 61% of those a high school diploma but nothing beyond that.

By income, 60% of those below $50,000 in annual earnings believe the forgiveness plan was politically motivated; for those above $50,000 in income, it was 72%.

So rather than being seen as a noble effort to ease the huge debt burdens of some struggling college graduates and current students, Biden’s move seems to be widely seen as a cynical political stunt to win votes in the upcoming midterms.

The skepticism should come as no great shock.

To begin with, it really doesn’t offer help to those who might need it most. A DailyWire piece noted, “The data suggests that President Joe Biden’s plan to forgive student loans amounts to a subsidy primarily to doctors and lawyers, and secondarily to people who acquired knowledge and skills that are not in demand.”

And even that might be understated.

The non-partisan Committee for a Responsible Federal Budget found, for instance, that recent moves by Biden to “pause” loan repayments and interest rates during COVID was a huge giveaway. On average, it gifted those with medical degrees with $48,000 in benefits, and those with law degrees with $29,500.

Then there’s this: It isn’t really debt “forgiveness” at all. It’s just someone else picking up the tab.

“No matter how you slice it, the government hasn’t forgiven loans. It has instead forced the rest of us to pay them back,” writes the American Institute for Economic Research. “Notably, it has forced people who didn’t go to college to pay for those who did.”

And the amount of relief may be quite a bit less than promised because of that old bugbear, taxes. At least seven states have already said they’ll tax the debt relief as unearned income, and others may follow suit.

As for the politics of the move, other polls bolster the I&I/TIPP findings.

As reported by the Daily Caller website, citing a Convention of States’ Action poll:

“More than 55% of voters are ‘less likely’ to back a candidate who is in favor of the Biden administration’s student loan forgiveness plan, with about 31% saying they are ‘much more likely’ to support those who backed the president’s plan … Among independent voters, 64.6% say they are ‘less likely’ to choose candidates who back the forgiveness plan.”

Moreover, while initial polls seemed to favor the idea, once some of the drawbacks were noted, support declined.

A Cato/YouGov national poll of 2,300 people found high support for the plan until respondents were asked if they would still support it if it led to higher taxes, mostly helped higher-income recipients, encouraged universities to raise tuitions and other fees, or encouraged more employers to require college degrees.

“The results are striking,” Reason noted, in reporting the data. “While 64% of respondents (and 88% of Democrats) back student-loan forgiveness of $10,000 for individuals earning up to $150,000 annually, those totals fall significantly once potential consequences are introduced.”

It seems Americans still recognize a fundamental truth about government handouts: There (still) ain’t no such thing as a free lunch.

Each month, the I&I/TIPP polling collaboration publishes data on this topic and others of broad public interest. TIPP’s reputation for excellence comes from being the most accurate pollster for the past five presidential elections.

Terry Jones is an editor of Issues & Insights. His four decades of journalism experience include serving as national issues editor, economics editor, and editorial page editor for Investor’s Business Daily.

Comments are closed.